by Bill McBride on 8/12/2012 10:06:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 35%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

An interesting point: Each loan type improved in Q2 2012, but the total delinquency rate increased. The reason is the shift in loan types - from prime loans to more FHA and VA loans.

Note: There are about 42.5 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2012 | Change | Q2 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 30,120,941 | -3,795,889 | 1,500,023 |

| Subprime | 6,204,535 | 4,031,216 | -2,173,319 | 918,714 |

| FHA | 3,030,214 | 6,827,727 | 3,797,513 | 614,495 |

| VA | 1,096,450 | 1,526,913 | 430,463 | 70,696 |

| Survey Total | 44,248,029 | 42,506,797 | -1,741,232 | 3,103,928 |

Click on graph for larger image.

Click on graph for larger image.

First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans.

This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2.

The improvement in late 2010 was a combination of the increase in number of loans (recent loans have lower delinquency rates) and eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible.

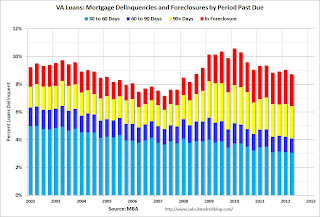

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).

There are still quite a few subprime loans that are in distress, but the real keys are prime loans and FHA loans.

Source: http://www.calculatedriskblog.com/2012/08/mortgage-delinquencies-by-loan-type.html

kathy griffin road conditions newt gingrich wives weather gina carano at last al green

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.